How The Bankruptcy Process Works

Filing for bankruptcy is one of many tools people in Tennessee have for taking control of unmanageable debt. However it is not a decision that should be taken lightly. It is one that should be preceded by healthy reflection, thorough planning and earnest prayer.

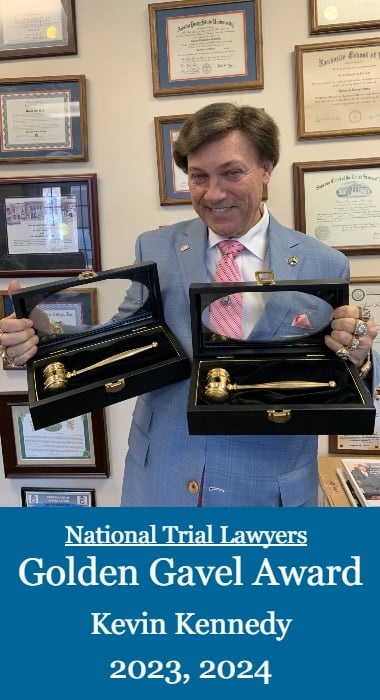

We at the Kennedy Law Firm, PLLC fully understand the gravity of this decision. We listen to your concerns and goals, help you weigh your options and guide you through any reasonable course of action you choose, whether it be debt consolidation or filing for bankruptcy. That is why people throughout the Clarksville area who take bankruptcy and debt seriously have trusted our attorneys for more than 18 years. We do not simply take the path of least resistance but give you our full commitment and take your case as seriously as you do.

When should you start considering bankruptcy?

Filing for bankruptcy usually should be considered as a last resort. If you have missed one or two payments or are beginning to struggle to make ends meet, there are several other options, such as debt consolidation or renegotiation that our attorneys can help you explore first. However if debt gets out of control, it may be time to consider Chapter 7 or Chapter 13 bankruptcy to prevent:

|

|

When debt starts interfering with your life in any one or more of these ways, filing for bankruptcy may be the next step you need to take. If you are still receiving a regular monthly income, you may do so under Chapter 13 without liquidating your property. However even under Chapter 7, fairly generous exemptions may allow you to file for bankruptcy in Tennessee without severely disrupting your life.

Taking the first step

While a great deal of preparation and analysis should precede it, the first official step of filing for bankruptcy is submitting a petition to the bankruptcy court. This should include providing information about your creditors, your assets, your income and your living expenses. In Chapter 13 cases, you may also submit a plan for repaying your debts with your petition, although it can be submitted up to 14 days after the petition is filed.

Accuracy and completeness are crucial in completing a bankruptcy petition and the attached schedules. Mistakes or omissions can lead to delays or, worse yet dismissal. Individuals and businesses throughout Tennessee can rely on the Kennedy Law Firm, PLLC and our more than 75 years of combined experience to ensure these crucial documents are complete and accurate.

Contact the Kennedy Law Firm, PLLC to learn your options for dealing with debt

Taking the first step toward bankruptcy can be difficult. However simply ignoring your debt is never effective. Our attorneys at the Kennedy Law Firm, PLLC can guide you through every step of the process and help you emerge with a new lease on your financial life. If you are struggling with debt in Tennessee, call us today at 931-444-5620 or contact us online to schedule a free initial consultation at one of our three convenient Downtown Clarksville locations.

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code.